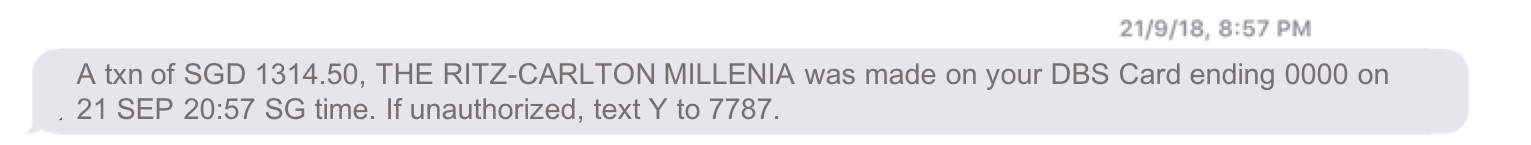

Machine Learning has proven to be invaluable in credit card fraud detection and prediction. With it, a bank can stop fraudulent transactions before substantial loss is incurred while allowing normal business transactions to proceed as usual. For example, when a customer makes a purchase using their credit card, they expect to get approval immediately. If the system identifies potential fraud it will send an SMS to the customer and ask for verification via the bank’s mobile app or SMS before processing the transaction.

But not all fraud detection systems are made equal. With ever-evolving threats that are growing more sophisticated by the day, banks need systems that can also evolve and adapt in order to defend against these threats. Want more info? Make sure you contact us for all these trending topics.

What should you look for in a modern fraud detection system?

1. Speed and Accuracy

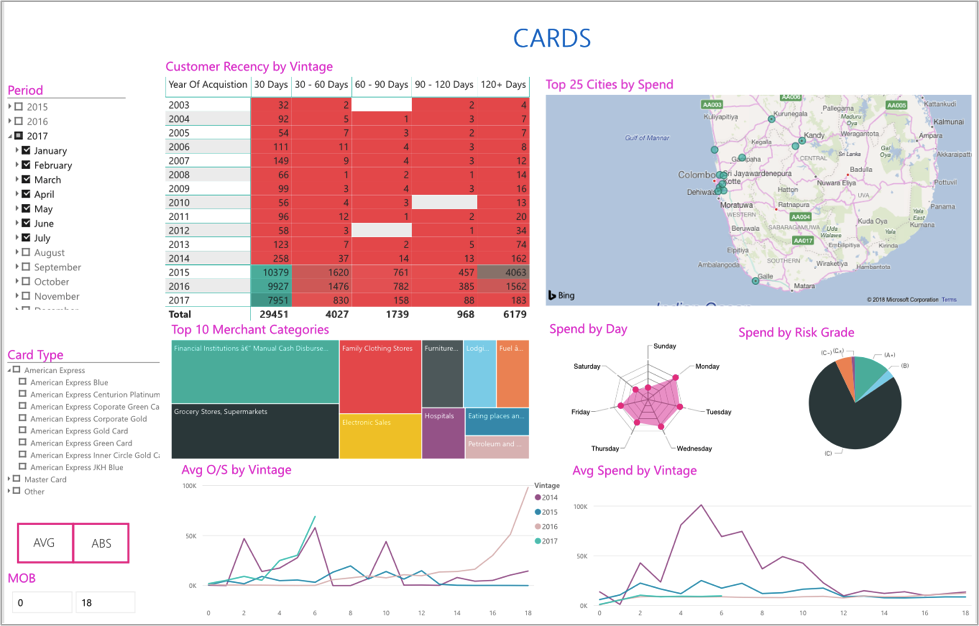

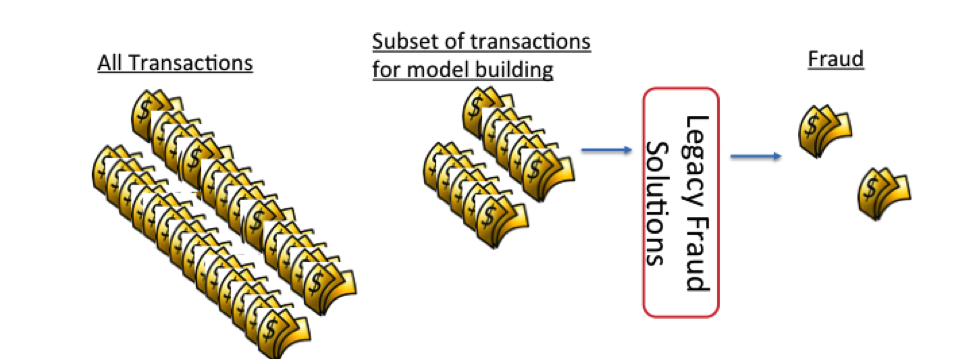

Banks often use sophisticated mathematical models created from known historical fraud to determine if a transaction occurring in real time is fraudulent or not. However most current or legacy approaches are largely static and rely on patterns and signatures derived only from a subset of historical transactions.

A modern fraud detection system should be able to detect suspicious events early and make decisions in a few milliseconds against all transactions, and not just a subset. The more data it can draw from, the more accurate its predictions.

2. Regularly-Updated Models

Another issue is the frequency with which the models are updated. In many cases the models used to detect fraudulent patterns are only updated once a year due to the difficulty, cost and time required for accurate model creation and deployment. A transactional fraud scheme may go undetected for months before being properly categorized in an updated model.

3. Ability to Minimize False Positives

Finally, the most important consideration for banks is the balance between flagging suspected fraudulent transactions with the negative impact on customer satisfaction when transactions are mistakenly declined. Reducing the number of these false positives directly relates to the accuracy of detecting fraudulent activities.

The advent of big data has made it possible to economically and efficiently store and process large amounts of data. Using comprehensive historical transaction data and leveraging a combination of supervised and unsupervised learning techniques we build a model that can analyze data on a huge scale in real time, and even detect first time fraudulent activities that have no known signatures with high accuracy. To see a summarized version of the scenario in discussion along with a shortened version of the working code, please have a look at our notebook on credit card transaction fraud detection. To get a detailed view of the code, you may want to have a look at our GITHUB code repository.

When done correctly, large-scale machine learning techniques can meet these criteria and offer an improvement over traditional linear regression methods, taking the precision of predictions to a new level. See how it works! Contact Just Analytics now.